Ready to stop feeling stuck and finally make progress with your money?

You’ve got the tools. Now it’s time for the plan.

If you’re tired of the anxiety, the debt, the "I’ll figure it out later” energy. this is your next best step.

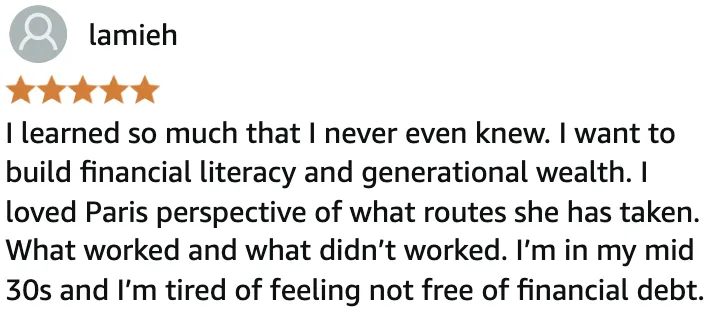

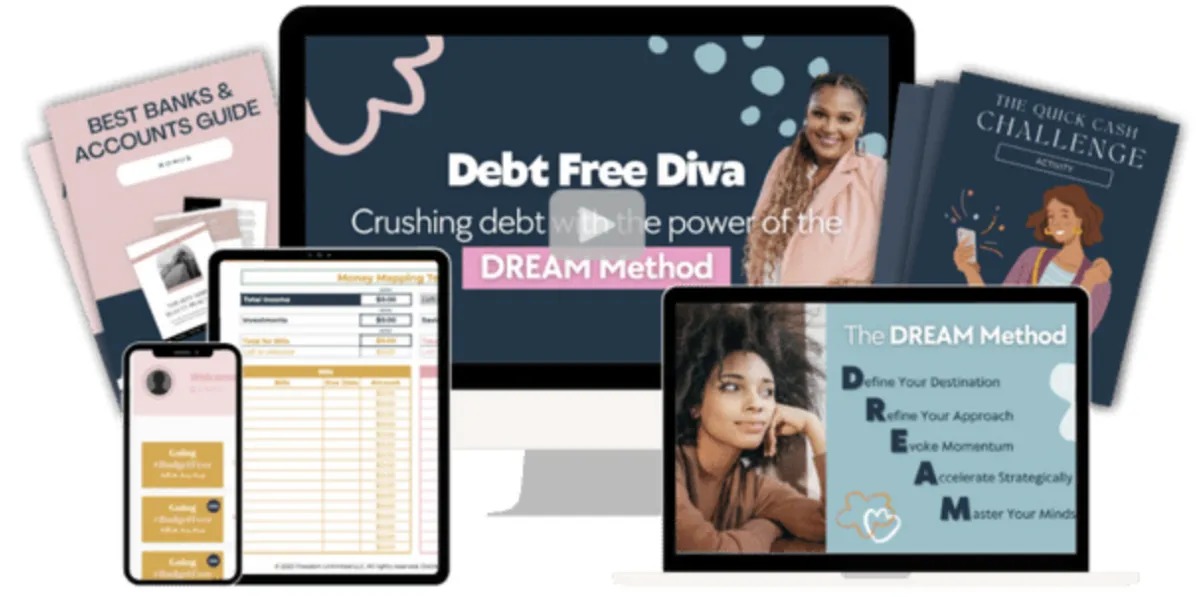

Debt Free Diva is a simple, affordable way to reset your finances and start fresh with confidence.

want a sneak peak? Watch this video👇🏻

Not sure which one fits you best right now?

If you’re wondering which course is right for you: Make, Manage, Multiply, or Freedom. No worries. That’s why I created a quick, powerful and free tool to help you decide.

Take the 2-minute free quiz to find your personalized starting point.

Why This Is the Perfect Next Step

The toolkit gave you clarity. This will give you MOMENTUM.

You don’t need to read another blog post or wait until payday to feel better about your finances.

You need a strategy that works and a system that sticks.

Debt Free Diva is designed to help you stop the financial bleeding, clear your debt with purpose, and get back in control of your money.

You don’t need to be perfect. You just need a PLAN.

You Shouldn’t Have To Give Up Everything You Enjoy To Become Debt Free.

Most debt elimination advice is as follows:

➡️ Sell your car, switch to public transport.

(...even if it means a 2-hour commute to work).

➡️ Rent a smaller place that doesn’t cost as much.

(...even if it’s a tiny shoebox 2 hours away from the nearest grocery store.)

➡️ Forget going on vacation, or even having date night anymore. You don’t need it.

(...even when work has been stressful and you’re burned out as it is.)

Sound familiar?

Yes, you can pay debt off that way if you want, but it’ll probably cost you your sanity in the process.

The good news is, you don’t have to.

That’s why I'd like to show you a simpler and easier way (that’s a lot more fun too!)

Also, Let’s Get Real For a Second...

According to recent research:

Over 60% of women in the U.S. carry credit card debt

Black women carry more student loan debt than any other group — an average of $37,558

And yet, we’re still expected to budget our way out, grind harder, and figure it out on our own.

No more.

You deserve a clear, proven strategy to get out of debt, one that honors your joy, your values, and your goals.

What If $83 Could Save You Thousands?

Debt Free Diva teaches you how to:

Create a personalized plan to pay off your debt without feeling deprived

Get clear on your goals, your habits, and your next steps using my DREAM Method

Ditch the shame and guilt and finally feel in control of your finances

Use real-life strategies that cut down your debt timeline (without sacrificing everything you love)

If $83 could help you ditch thousands in debt, would it be worth it?

You’re meant to be debt free

Introducing

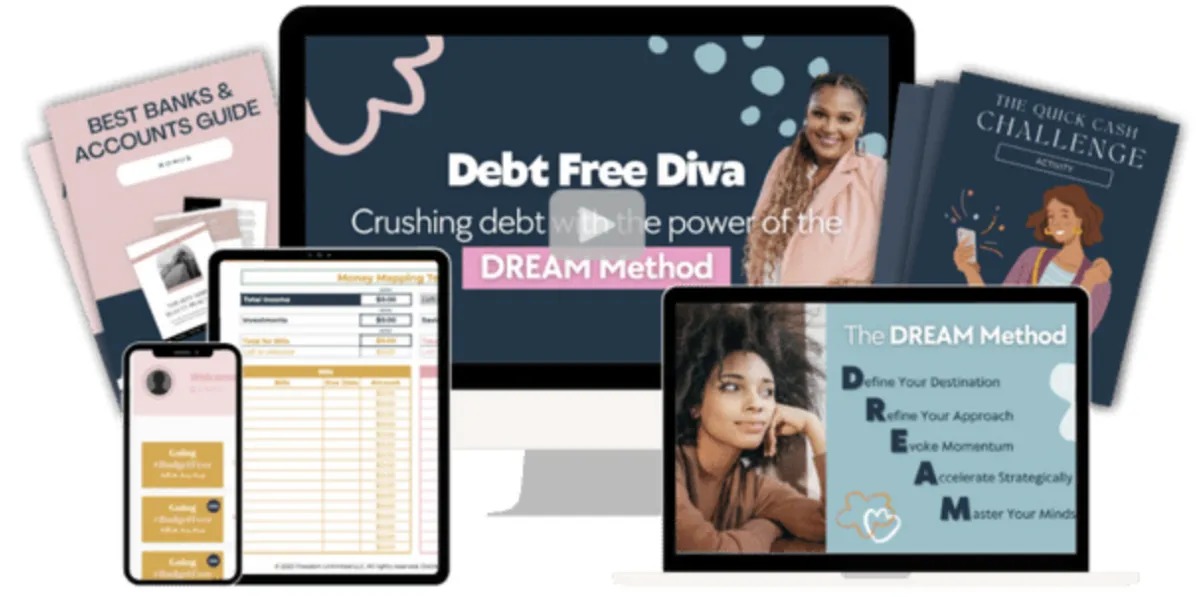

Debt Free Diva

Discover The 5-Step DREAM Method to Rapidly Paying Off Your Debt Without Having To Give Up Everything You Enjoy

Here’s The Exact Debt-Elimination Method You’re Going To Discover Inside Debt Free Diva:

The DREAM Method

Define Your Destination

It can often feel less stressful to just put up with your debt than actually making an action plan to deal with it. But after mapping out your plan, you might find you’re closer to debt freedom than you thought.

That’s why the first step is to take stock of everything – where you are now, where you want to be, and how long it’ll take to get there.

Refine Your Approach

Myth: Getting out of debt requires enduring constant deprivation from everything you enjoy.

Reality: It’s possible to become debt-free without compromising the values and little luxuries that you hold dear.

That’s why step 2 of our debt freedom plan is all about picking a plan to eliminate debt that is as realistic, rapid, and sustainable as possible.

Evoke Momentum

Now that you’re on the pathway to debt freedom, I’m going to show you a few simple ways you can make your journey easier, smoother, and faster. I’ll even show you my 3 favorite strategies for generating some extra cash FAST, whenever you need it.

Accelerate Strategically

If you want to cut your timeline to debt freedom in half, then these strategies should be your first port of call.

These strategies are totally optional, but will help you shave months (even years) off your debt elimination journey if you lean into them.

Master Your Mindset

One of the most overlooked tools in the pathway to debt freedom is your mindset. It’s what will help you follow through with your debt elimination plan, and what will help to keep you out of debt going forward.

Discover how to maintain motivation when the going gets tough, as well as how to stay grounded when the random urge to splurge comes knocking!

What Others Say About Paris Woods’ Methods:

Maija Ross, Product Management

“I Would Recommend Paris’ Coaching Services To Anyone Who Is Ready To Accelerate Their Progress Toward Financial Goals.”

"As a coach, Paris has helped me reflect, vision, and action plan in a way that has moved me closer to my goals during each session. I love that when any of us present a problem/challenge Paris provides candid feedback and shares her personal and professional experiences and resources for guidance. I would recommend Paris’ coaching services to anyone who is ready to accelerate their progress toward financial goals."

Brendalyn King, Leadership Coach

“Dr. Woods Has Dedicated Herself To Serving Black Girls With An On-Ramp On The Road Toward Financial Freedom.”

"Black women are left often teaching themselves about their finances yet we are running homes and serving in communities where others depend on our knowledge to get unstuck.Dr Woods knows this all too well and has dedicated herself to serving black girls with an on ramp on the road toward Financial Freedom."

Nanayaa Kumi, International Affairs

“I Now Have The Proper Guidance And Tools In Place To Manifest The Fire Future I’ve Been Working Towards.”

"I now have the proper guidance and tools in place to manifest the FIRE future I’ve been working towards. I highly recommend Dr. Woods’ book and course to anyone willing to invest the time and effort to plan and manifest a dream life of financial freedom."

Why It’s Worth It:

Let’s break it down:

Credit card interest averages 24% and your debt is literally costing you money every single day.

Join for $83, a one-time payment that could help you save thousands over time.

If you could buy your peace of mind for $83… would you wait?

Think of it as:

Less than the cost of one dinner out

Cheaper than a pair of shoes you’ll forget next season

A whole future without debt hanging over you

ABOUT YOUR GUIDE

Paris Woods

Paris Woods is a first-generation college graduate of Harvard University and a lifelong educator, having worked at some of the country’s top institutions.

The daughter of a wise mother who encouraged her to venture out into the world and make “new mis- takes,” Paris learned the hard way how to manage her finances and achieve financial freedom. Through years of trial and error and the guidance of numerous FIRE (financial independence, retire early) experts, Paris landed on some simple principles that completely turned things around for her financially and in life.

Paris is a two-time graduate of Harvard University with a bachelor’s degree from Harvard College and a master’s degree from the Harvard Graduate School of Education. She also holds a doctorate of education from the University of Texas at Austin.

You took the first step by downloading the Toolkit. Don’t stop there.

Debt Free Diva will help you take real action without shame, confusion, or overwhelm. This isn’t about becoming a finance expert. It’s about becoming free.

🔒 Risk-Free Investment

This is a one-time purchase, not a subscription.

You keep access forever, and you can start whenever you’re ready.

The sooner you begin, the sooner you’re free.

You deserve a debt-free life without burnout, without guilt, and without giving up everything you love.

And for the next 48 hours, you can join for just $83.

90-Day Money Back Guarantee

My guarantee is simple:

Try the program for 90 days. Start chipping away at your debt. Take those all important first steps towards debt freedom.

And if at any point during that 90-day period you don’t see the value of what I’ve shared with you…

Then you can claim a full refund.

All it takes is an email to [email protected].

Sound fair?

Copyrights 2026 | Paris Woods | Terms & Conditions